Finding your perfect person can make you feel like you’re on top of the world. However, after the ceremony, reception, and honeymoon, you and your sweetheart may begin to feel the stress of money management. Combining two lives into one takes time. The same is true with your finances. Together, you’re now responsible for the well-being of each other, one penny at a time.

First things first.

Before you start making any decisions or budgeting plan, sit down with your partner and have an honest discussion about financial goals and struggles. Having a transparent partnership where you work together to achieve financial success, will ensure you view finances as team effort instead of a me-versus-you mentality. Once you’re aware of each other’s debts and savings goals, you can begin to make a plan on how to best achieve your joint financial freedom.

Always put it in writing.

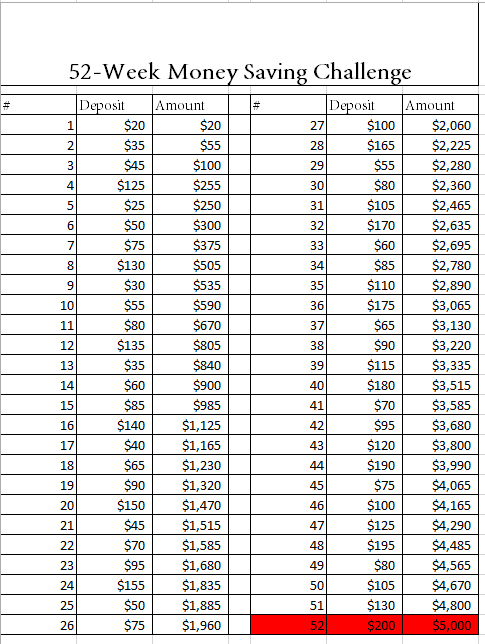

A plan is the perfect place to begin your new financial journey. With your savings goals in mind, you can tailor a budget to both pay off debt, and efficiently save for long-term goals. No matter if it’s on your household computer, shareable Google Doc, or simple a written chart in the office, having an accessible budget can help you check and balance your spending throughout the month.

What’s yours is mine.

Putting your money where your mouth is has never been truer than in marriage. Joining in union not only means a ring and shared life, but combined finances as well. Setting up a joint checking account is a great first step in managing your funds together. This account should be delegated to all household spending such as rent, utilities, groceries, and other combined expenses. By having an account you both contribute to, you can ensure that these funds are accumulated for joint expenditures only.

Remember to be yourself.

While being married is about doing many things together, it also means being comfortable apart. Some hobbies may be unique to you and your personality, while others you two may enjoy together. Take this into account when creating your budget, and allocate an “allowance,” for each person every month. These funds can be spent on anything from movies to makeup, or you each can save your funds for a purchase of your own choosing. This is a great tool to help you both enjoy your own independence while still being conscious of your joint spending.

If you have other questions on budgeting, savings, or checking accounts, drop us a line, or stop by today!